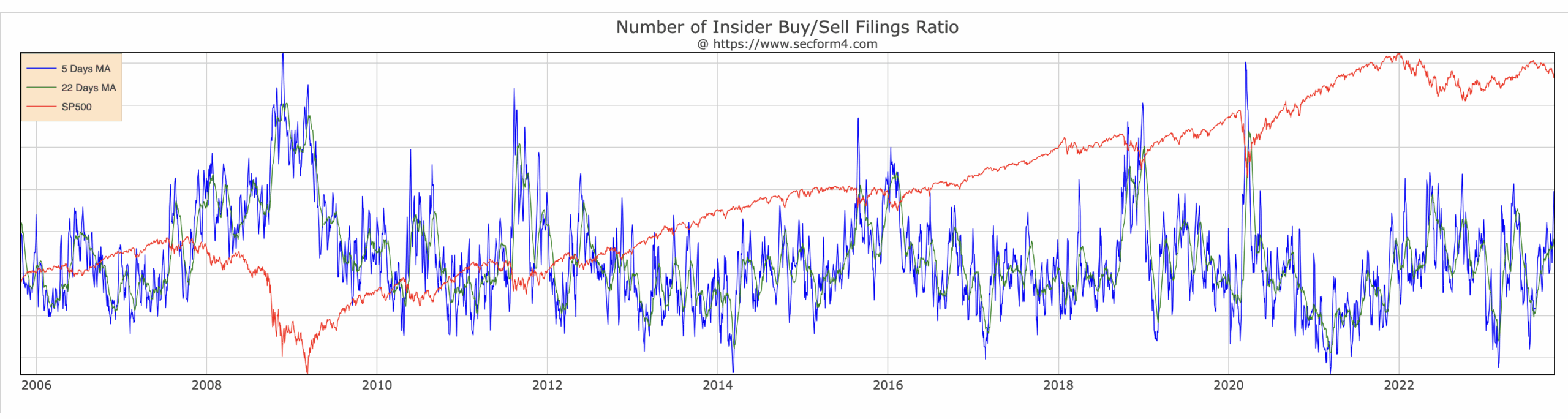

Insider Buying Week 11-03-23 Insider Buying offers Clues as to where Bargains might Await

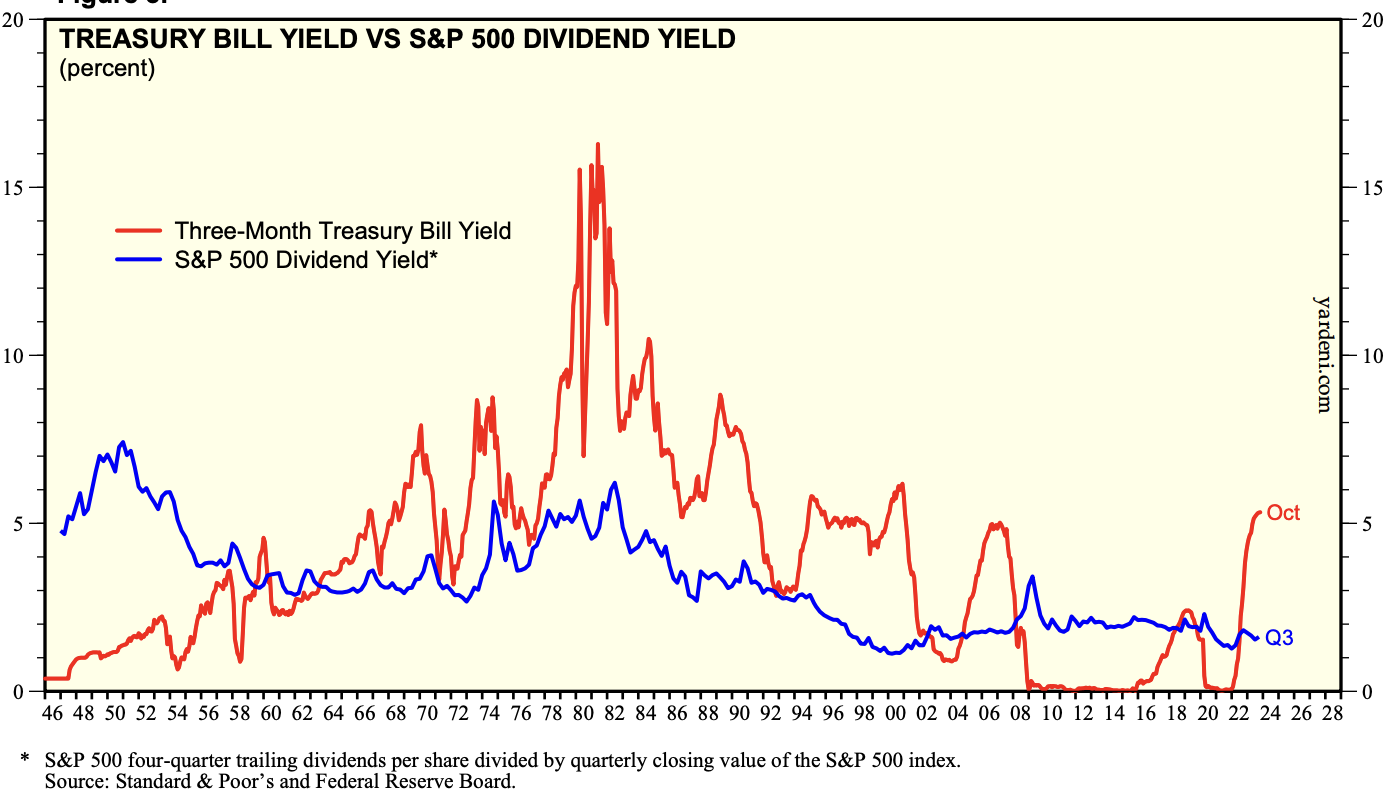

The difference between the 10-year Treasury Bond yield and the S&P 500 dividend yield is the largest it’s been since 2007. The spread between interest earned on Treasury Bills and dividends reached levels not seen in 40 years. ~5% money market rates and an S&P 500 dividend yield of 1.52% cannot coexist indefinitely. This is not a condition for equilibrium. Something must give. Great amounts of money will be made in getting this right. In the immortal words of Dylan, the poet laureate, “Something is happening here; But you don’t know what it is.” The market changed its narrative last week from higher for longer … Read more