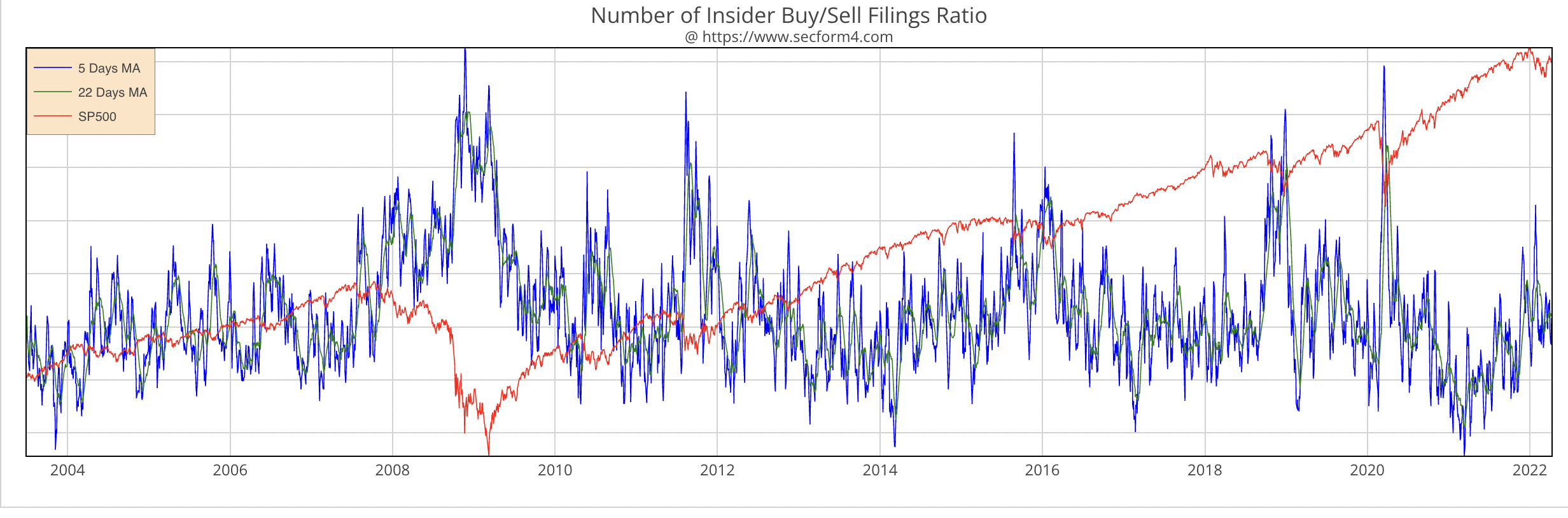

Insider Buying Week 11-21-25 AI Bubble Bursting or Buying Opportunity

Volatility isn’t just knocking—it kicked the door down. It had been building gradually, fueled by a series of confidence-shaking events: government shutdown fears, air travel restrictions, Fed dot-plot uncertainty, and persistent warnings of an AI bubble. Last week, that pressure finally exploded like a Yellowstone geyser. The market boogeyman came out of the closet, bringing a 1,000-point Dow reversal that spiked the VIX. While pundits offer endless explanations, this sell-off looks like a classic delayed reaction to Nvidia’s earnings. The rout was most intense in AI and Crypto—with Bitcoin shedding 12.9% and the Nasdaq down 2.7%. Meanwhile, the broader market … Read more