Insider Buying Week 08-09-24

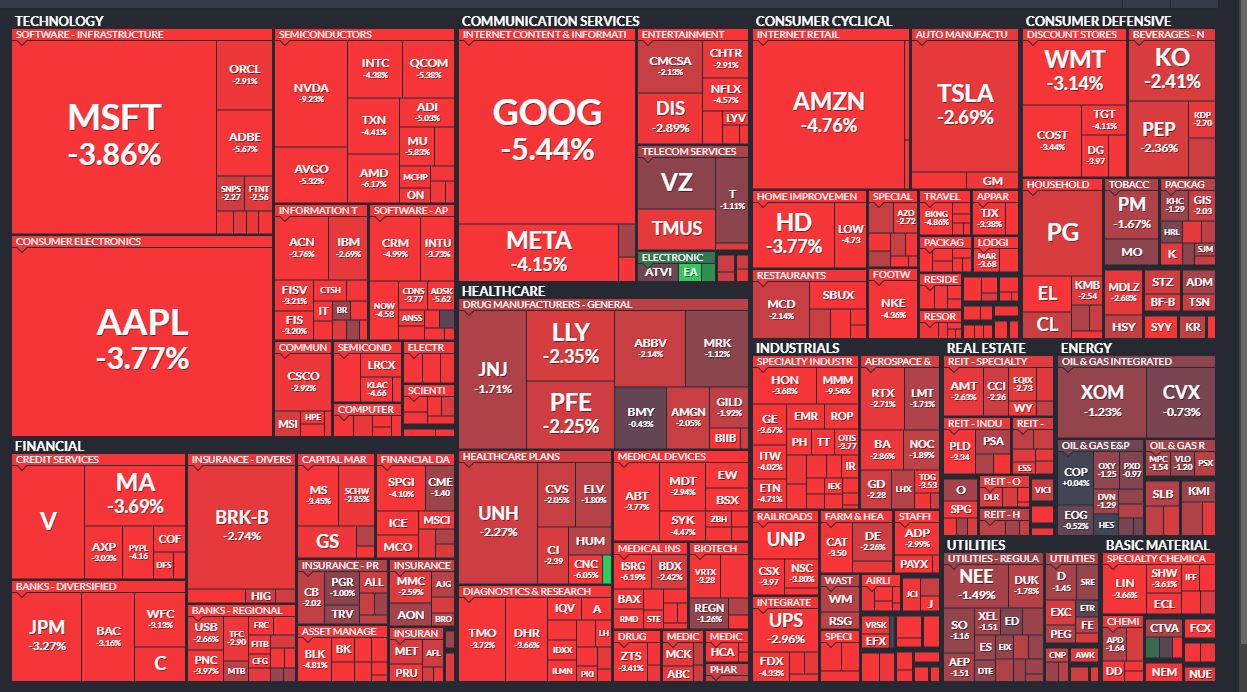

Someone wrote last week that the situation in the market was ripe for a crash, reminiscent of the Crash of 1987. I lived through that, so I have some personal observations. Name: Thomas Arthur Bell Position: CEO Transaction Date: 2024-08-01 Shares Bought: 1,712 Average Price Paid: $145.04 Cost: $248,305 Company: Leidos Holdings Inc. (LDOS) Leidos Holdings, Inc. was founded in 1969 and has its headquarters in Reston, Virginia. Leidos Holdings, Inc. and its subsidiaries offer services and solutions in the defense, intelligence, civil, and health markets in the United States and abroad. The company’s segments include Defense Solutions, Civil, and … Read more