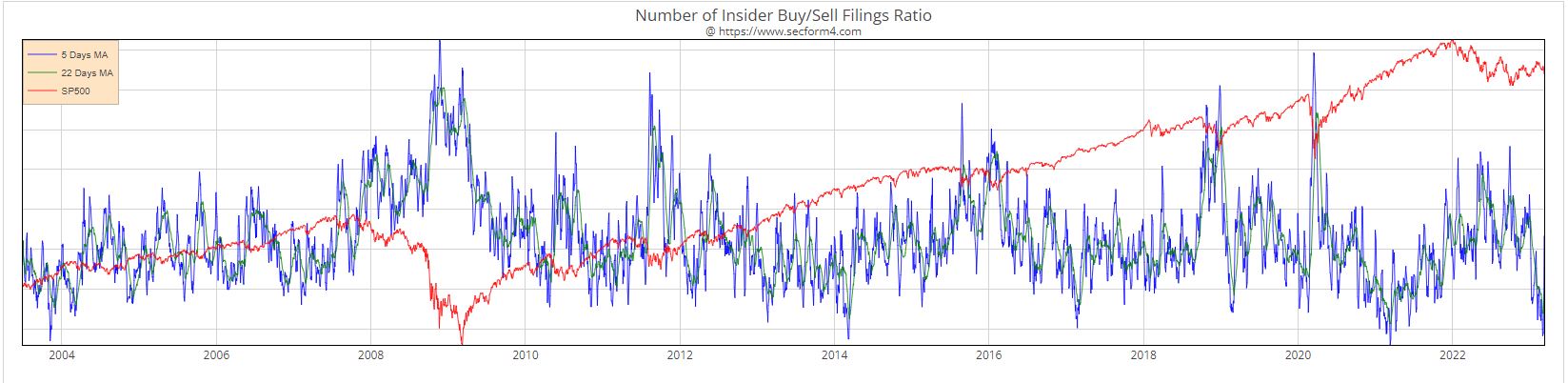

Insider Buying Week 5-26-23

It’s all AI, Chat GPT, large langauge models, and generative image models. Nvidia’s blowout quarter and guidance sent the market into a bull run seizure moment. Meanwhile, you hear more and more stories about fake information generated by this “breakthrough AI,” including the latest example on Twitter where an attorney was reprimanded by a judge for his brief, which included fake prior cases entirely fabricated by AI. We can’t ignore the promise, but we certainly shouldn’t be blindsided by the hype. Tread carefully here. At the Insiders Fund, we try to filter out the noise. Here’s what real insiders are … Read more