Insider Buying Week 12-05-25 Is the Current Low VIX the Quiet before the Cannon Fire?

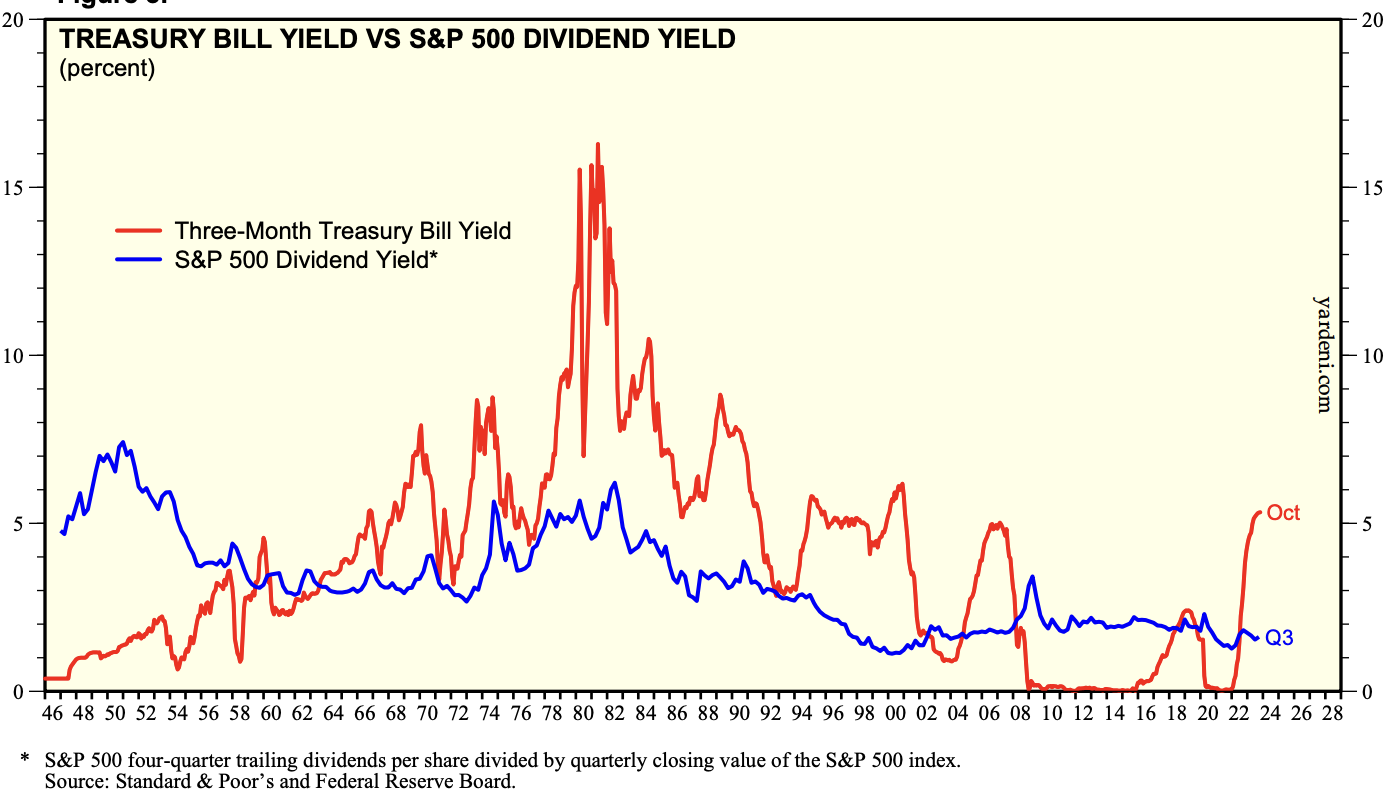

The market sustained its upward trend, advancing by 0.44%. The Nasdaq Composite demonstrated stronger performance, rising by 0.91%. The previous volatility spike in November appears distant, as the VIX has reached historic lows. While portfolio insurance may seem cost-effective in this environment, it is important to consider the current context. Insurance never looks cheap when you need it and when it is cheap, you rarely need it. Thus the goldilocks moment we are in. Insider purchases, which often serve as confidence indicators, are unavailable during the blackout period, which occurs at the end of each quarter before required filings are … Read more