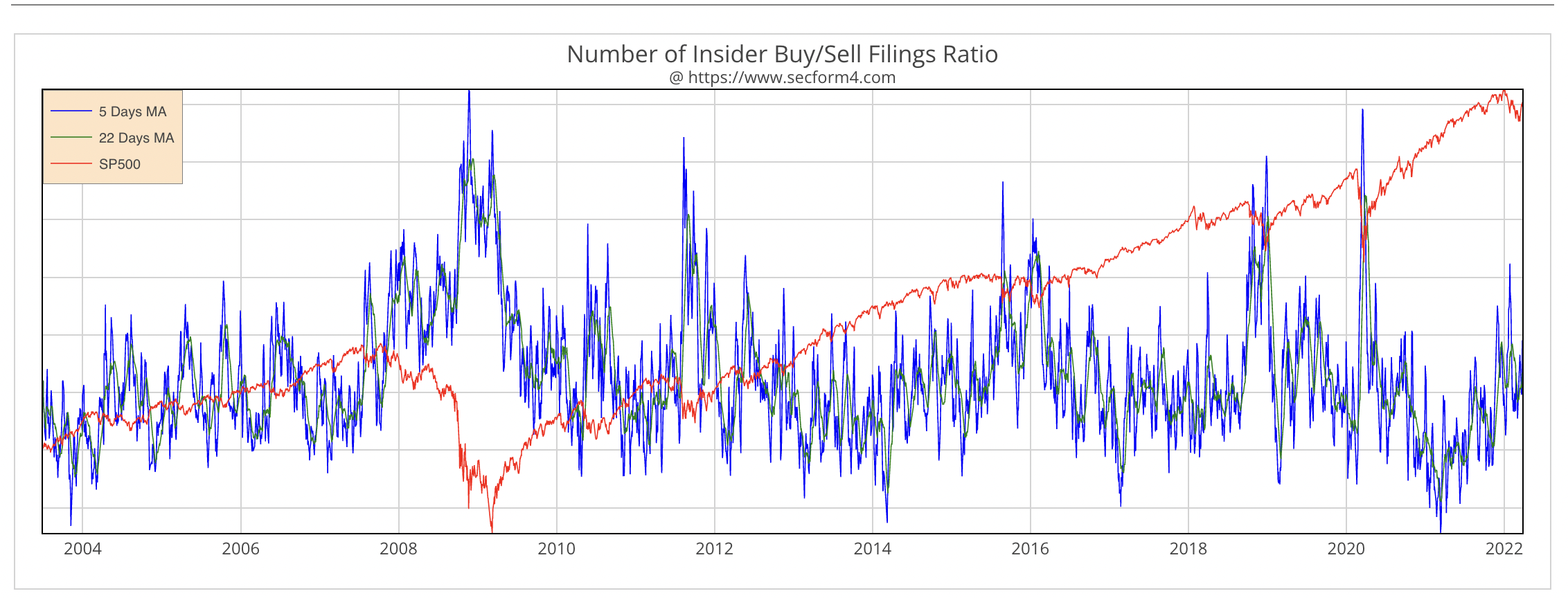

Insider Buying 03-14-25 Nothing Good Happens Below the 200 Day Moving Average

CHAOS 2.0 seems to be morphing into Insanity 1.0. Consumer confidence is plunging, businesses are scrambling for direction, and the world seems like a far more dangerous place as we turn allies into enemies. The stock market is a giant real time voting machine, imperfect and prone to panic just like real people. The 1st Quarter is coming to a close which also means insiders are blacked out from buying their stock. Living below the 200-day moving average is a constant struggle between doubt and conviction. Without insiders confirming our decisions, it will be even more challenging than normal. The … Read more