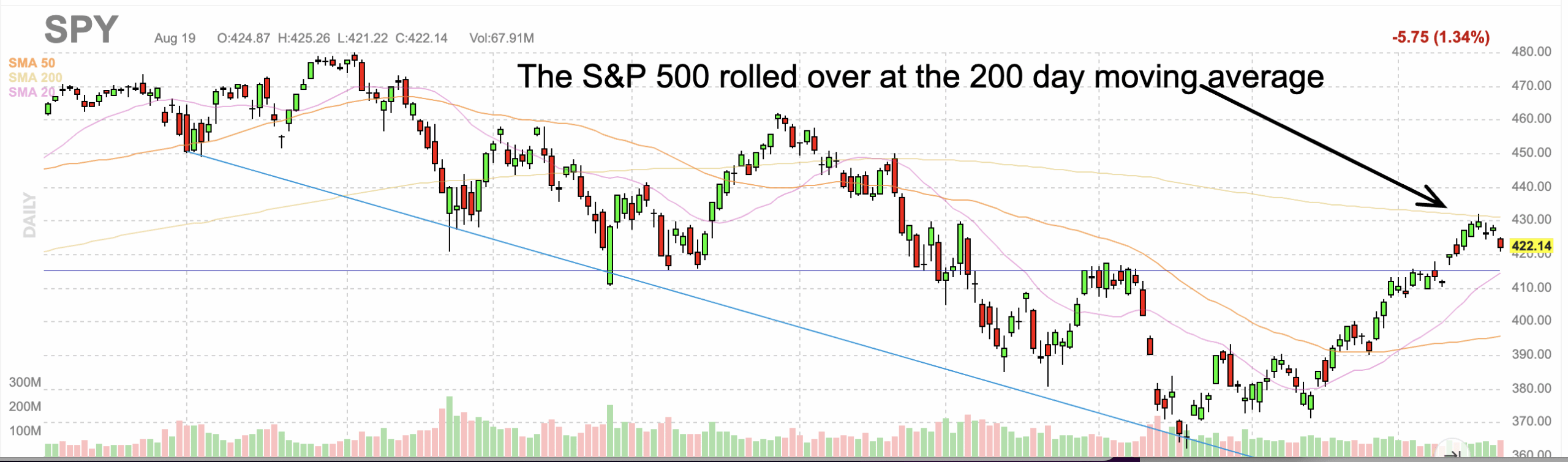

Strange Days Insiders Abandon the Market Week 10-21-22

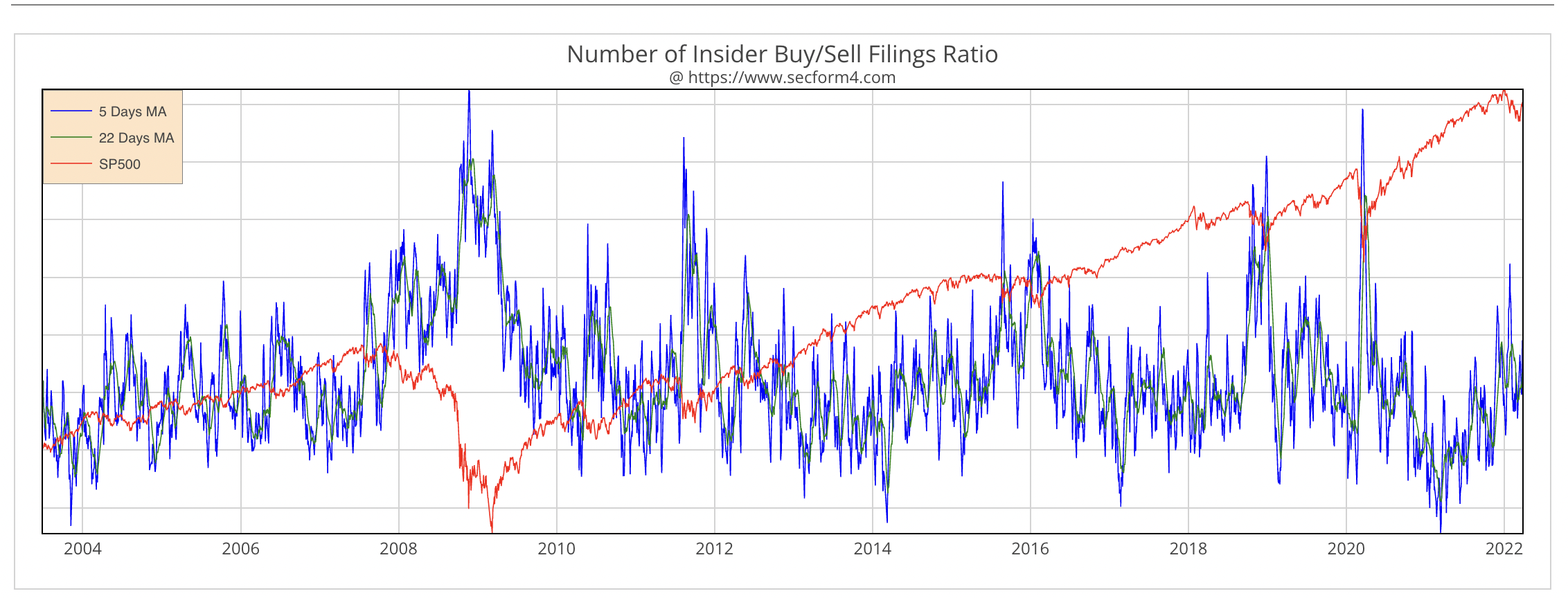

“Strange days have found usStrange days have tracked us downThey’re going to destroyOur casual joysWe shall go on playing or find a new town”- the Doors 1967 We had some technical difficulties with The Insiders Report in getting our payment module to work. So until we can figure out where the theme and the payment module collide, The Insiders Report is free. Unfortunately, there isn’t much in the way of insider activity to write about, but that’s not stopping the market from lifting. The Dow soared 748 points, and the S&P rose 2.37% on Friday ending one of the … Read more