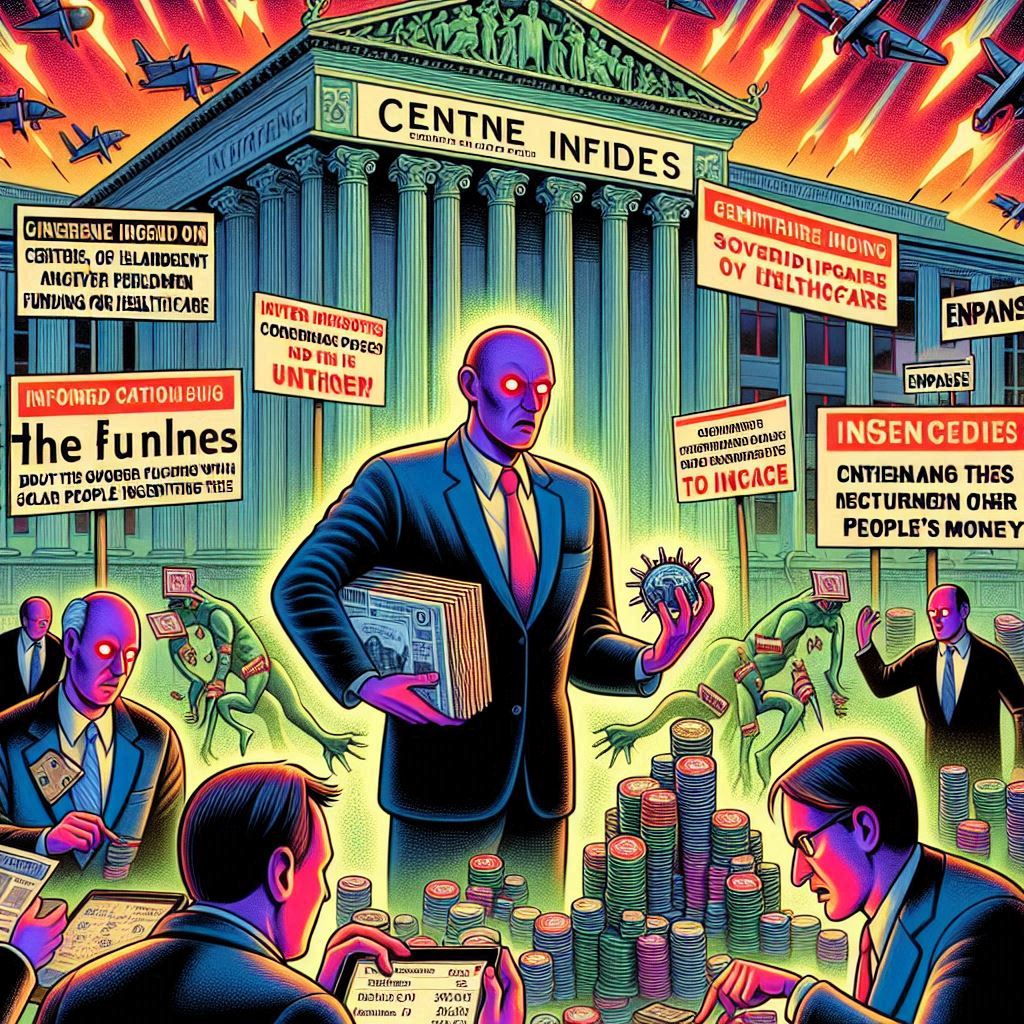

Insider Buying Week 11-15-24- Animal Spirits are Back!

After weeks of nonexistent insider buying, other than hedge funds which I generally dismiss as informed but not that meaningful OPM other people’s money, insiders have come back with a vengeance. Some likely unleashed by Trump’s change of regime optimism, while others were likely motivated as the market prematurely selected winners and losers. Centene insiders began buying shares shortly after the election results raised concerns about government funding for healthcare. Enphase, already struggling, faced further declines as solar energy incentives came into question. Meanwhile, semiconductor stocks, with the sole exception of Nvidia, are dropping sharply due to the potential reintroduction … Read more