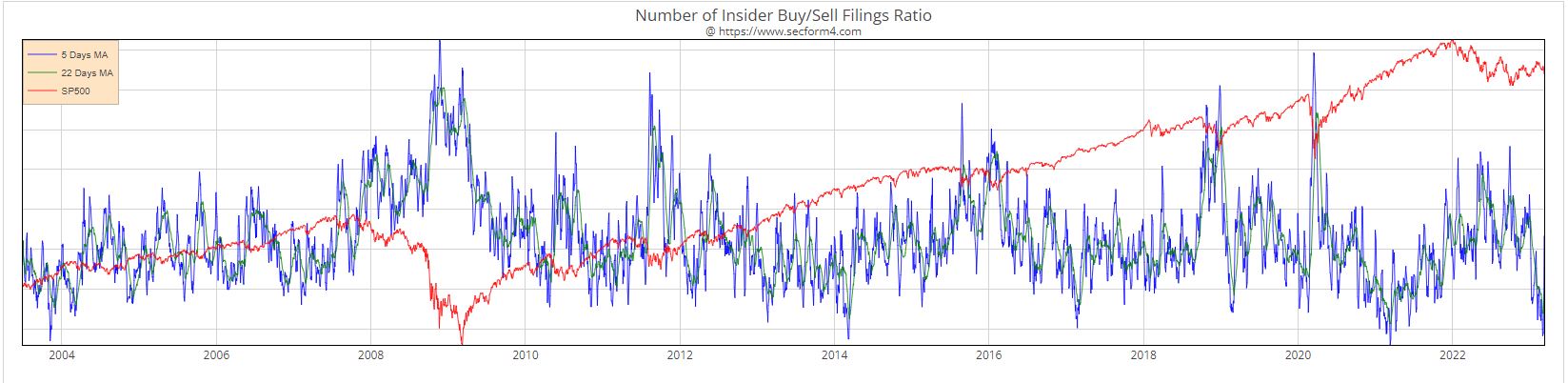

One way this is not like 2008, Insiders are NOT Buying -Insider Buying Week 3-10-23

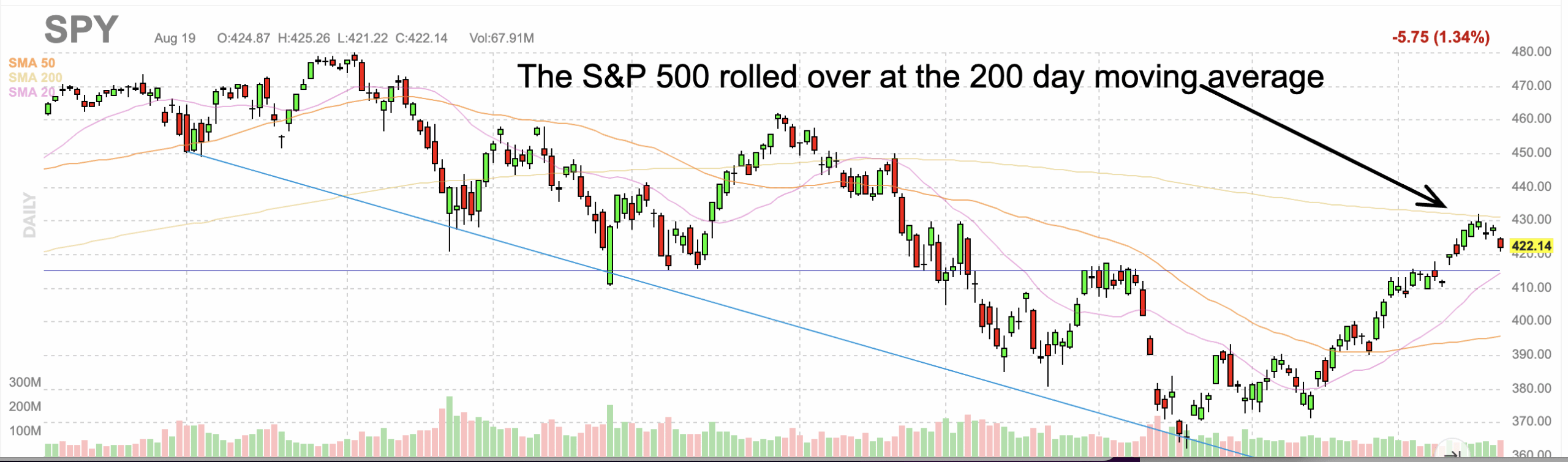

This is LIKE 2008, contrary to what you may have heard about the recent Silicon Valley Bank failure. Banks either don’t want to pay competitive deposit rates or can’t. Competing with Fed Chairman Powel’s ~5% treasuries is hard. Actually no banks can compete with it. Vast sums are being withdrawn from the banking system. Ironically the stock market is on the only place you will be able to compete with the yield crisis that the Fed is precipitating. Many solid companies are paying good dividends with the likely prospect of raising them. So tell me, how is this not like … Read more