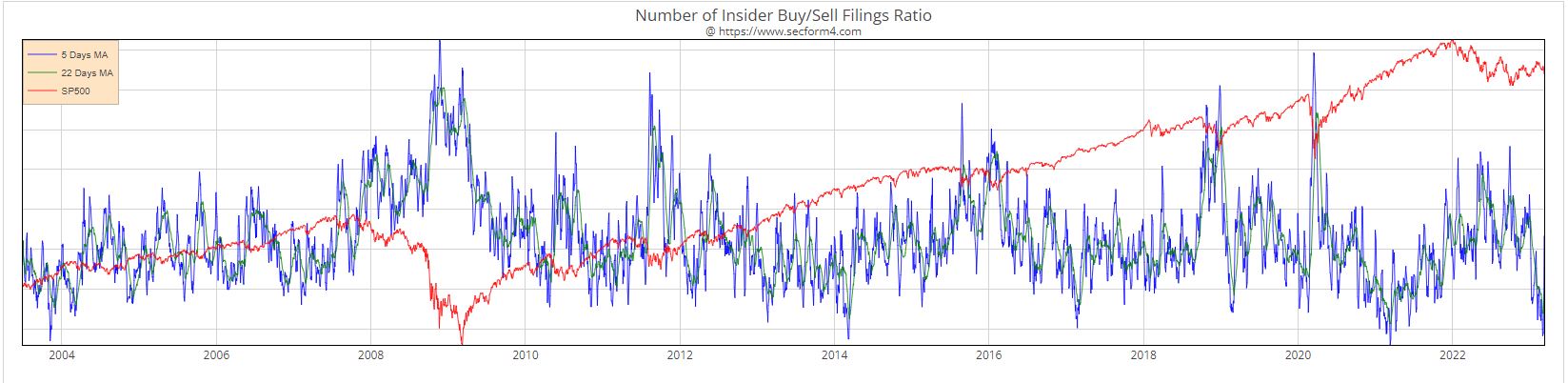

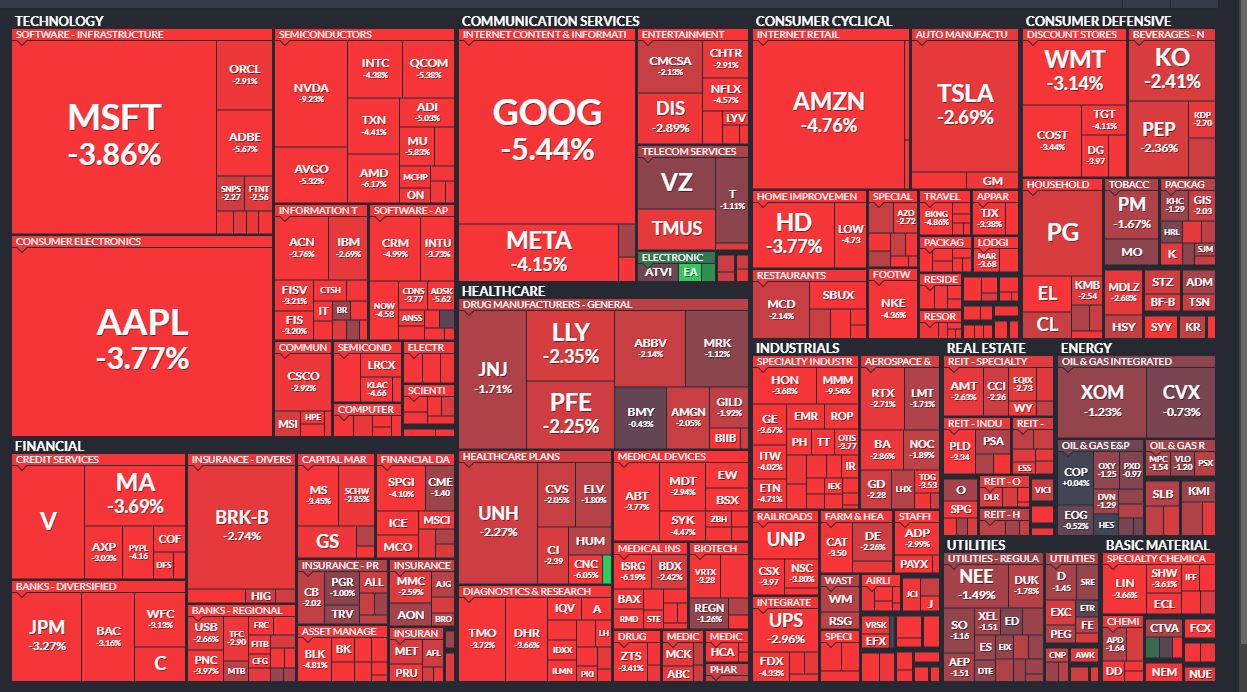

Insider Buying Week 6-09-23 Investors are Clipping Coupons while the S&P 500 storms higher 12% YTD

It was a quiet week when it came to insider buying. Dish Networks had a big percentage move off the bottom as rumors floated that Amazon might be finally making a move with the cellular bandwidth that Dish has spent so many billions of dollars accumulating. On Friday, it gave back 12.5%. Nothing deters Director DeFranco as he bought $ 1.8 million more of Dish. There might actually be a plan for their madness, and it may have nothing at all to do with Amazon. Perhaps there is a SpaceX rescue coming? At this point, Dish stock is like an … Read more