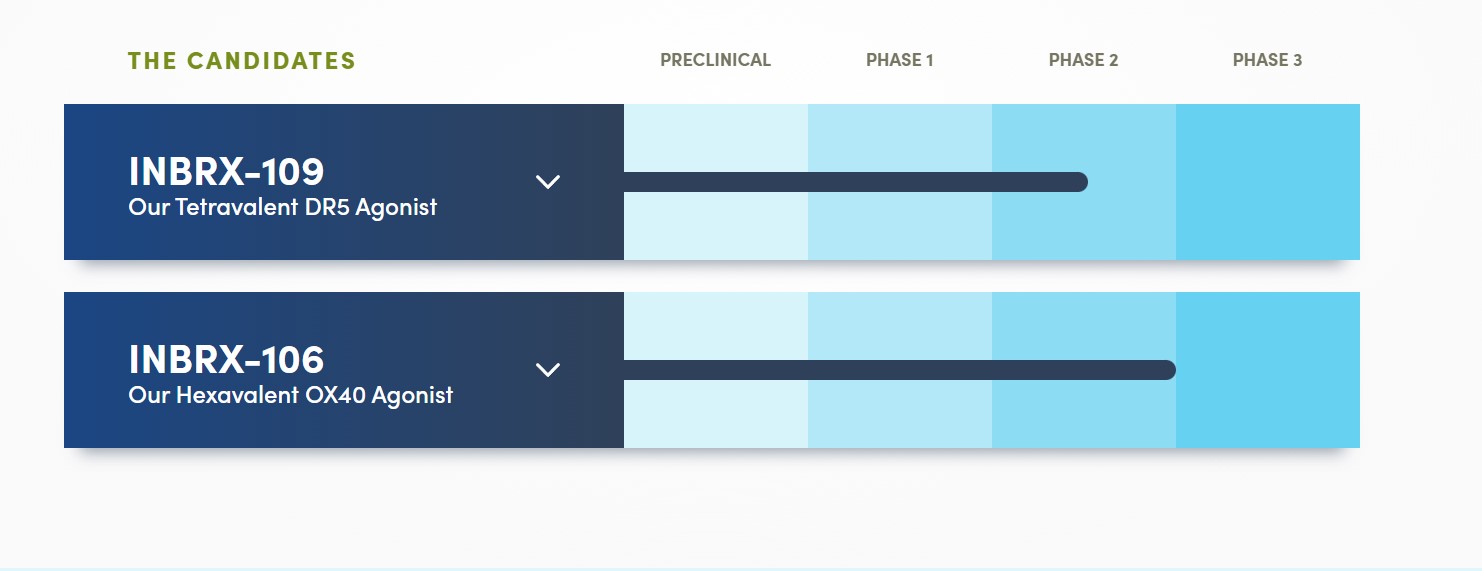

Insider Buying Week 08-30-24 A Return Visit to Inhibrx Biosciences

Insiders buy their stock when they think it’s cheap or sometimes when they want to keep their jobs. The investor must figure out that difference. There are a few names I’d venture to short on this list if the Vig is not too high. There are a few names that offer compelling narratives, if not fundamentals. You can be an insider, too– by clicking here Name: Gary L Hinkle Position: Director Transaction Date: 2024-08-23 Shares Bought: 5,000 Average Price Paid: $68.09 Cost: $340,450 Company: Burke & Herbert Financial Services Corp. (BHRB) Burke & Herbert Financial Services Corporation was formed … Read more