Insider Buying Week 7-28-23 Euphoria has Begun

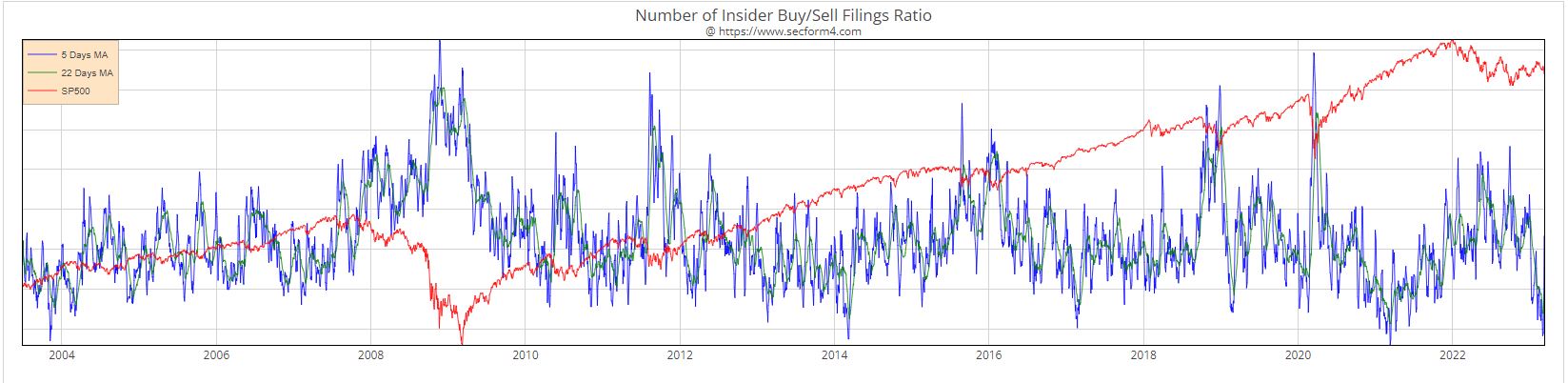

Last week pretty much heralded the end of the bear market. True, long-lasting bull markets start with a plethora of insider buying. That’s obviously not happening. I’m trying to figure out what that means. Every significant market correction ended with a near explosion of the insider buying versus selling ratio going vertical. Right now, insiders are cautious. I think we should be too. That doesn’t mean there won’t be anomalies. Name: John H Stone Position: President and CEO Transaction Date: 2023-07-27 Shares Bought: 17,500 Average Price Paid: $116.62 Cost: $2,040,892 Company: Allegion plc (ALLE) Allegion plc, a leading … Read more