Insider Buying Week 8-5-22 CARVANA NIRVANA

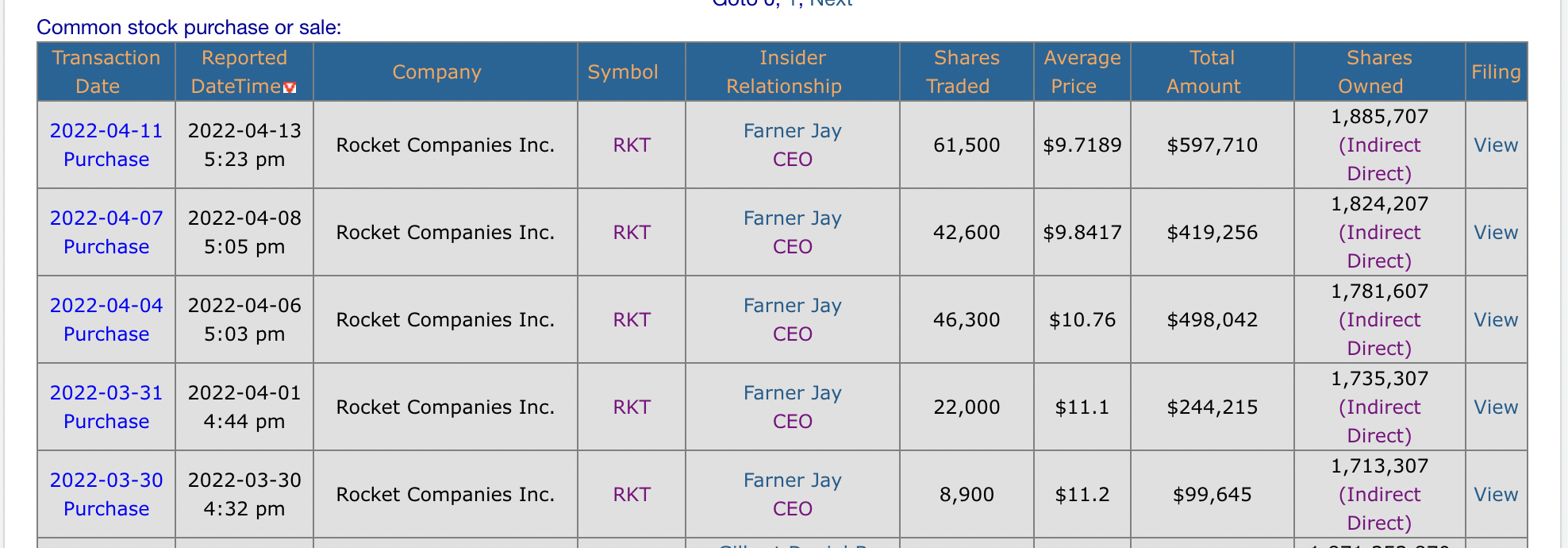

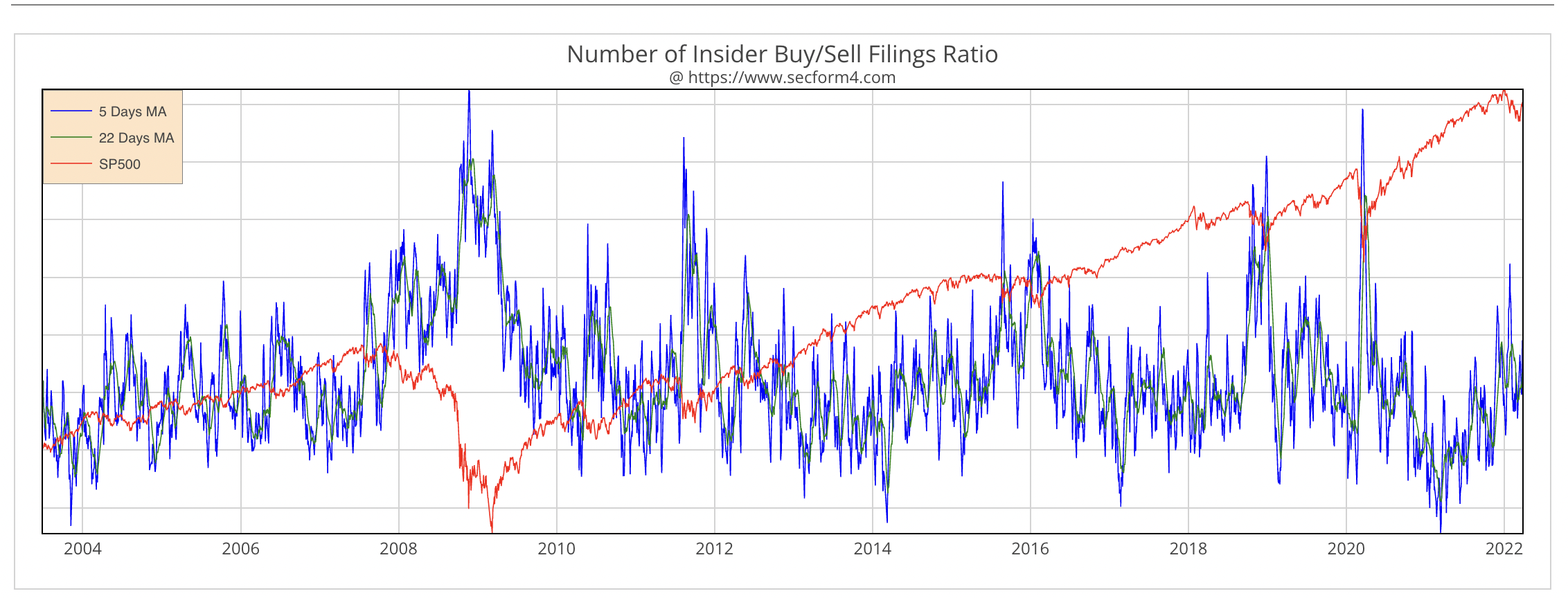

Curious how well insiders are doing with their buys? The Insider Report hit the ball out of the park Friday, August 5th. We hope you were in the stands with us to watch Carvana CVNA soar out of the stadium, up 40%. We have blogged about it several times in the Insiders Report. Numerous short sellers were saying that CVNA was going to go bust, and it reportedly had a short ratio of 40%, one of the largest out there. That means 40% of the holders of Carvana were betting it would go down, not up. Today they felt a … Read more