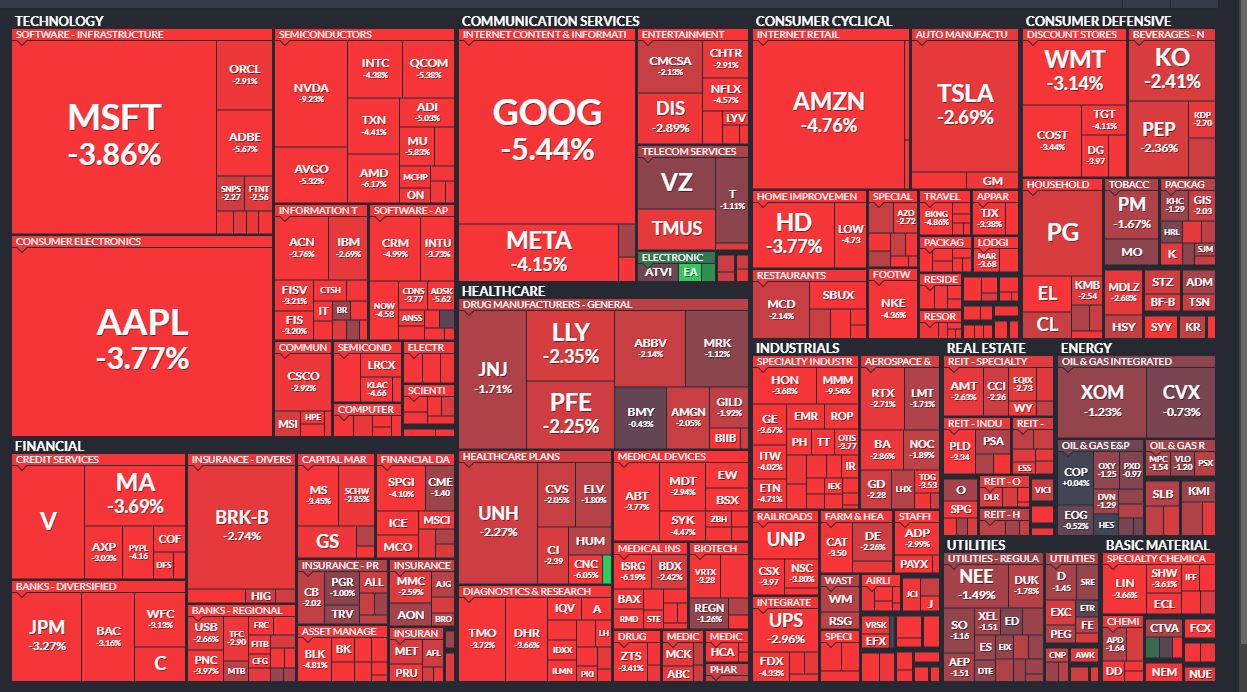

‘t want to go down.

Despite the best efforts of banking emperors like Jamie Dimon of JP Morgan or all-knowing market strategists like Mike Wilson of Morgan Stanley, this stock market refuses to go down. Last week’s market rally has already numbed the pain from February’s losses. The bulls are stomping their hoofed feet at the fences, dying to bust out. An insomniac lies awake at night, Puzzling over a conundrum so tight; the answer eludes them, it’s out of sight, And the puzzle keeps them up till daylight. They toss and turn, and they try to sleep, But the puzzle is just too deep; … Read more