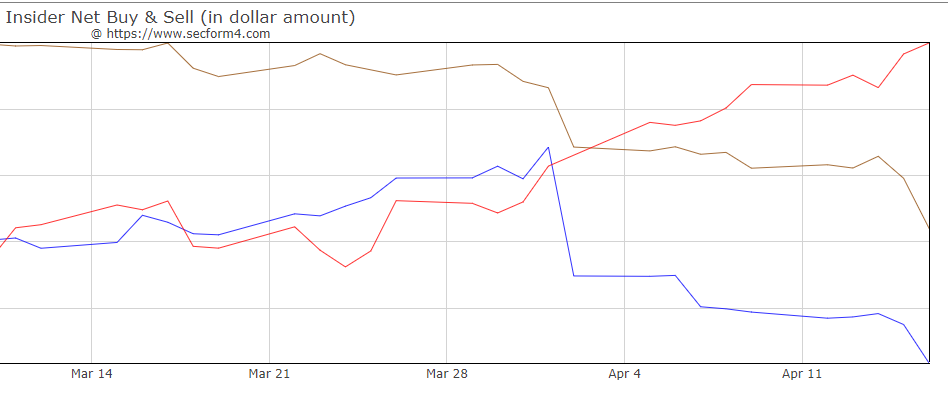

Insider Buying Picks Up Dramatically Week 8-06-21

For trade, details click on this link to the trades. Name Sachs Bruce I Position: Director Shares Bought: 15,000 Average Price Paid: $197.91, Cost: $2,968,650 Company: Vertex Pharmaceuticals Inc. (VRTX) Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has multiple approved medicines that treat the underlying cause of cystic fibrosis (CF) – a rare, life-threatening genetic disease – and has several ongoing clinical and research programs in CF. Beyond CF, Vertex has a robust pipeline of investigational small molecule medicines in other serious diseases where it has … Read more