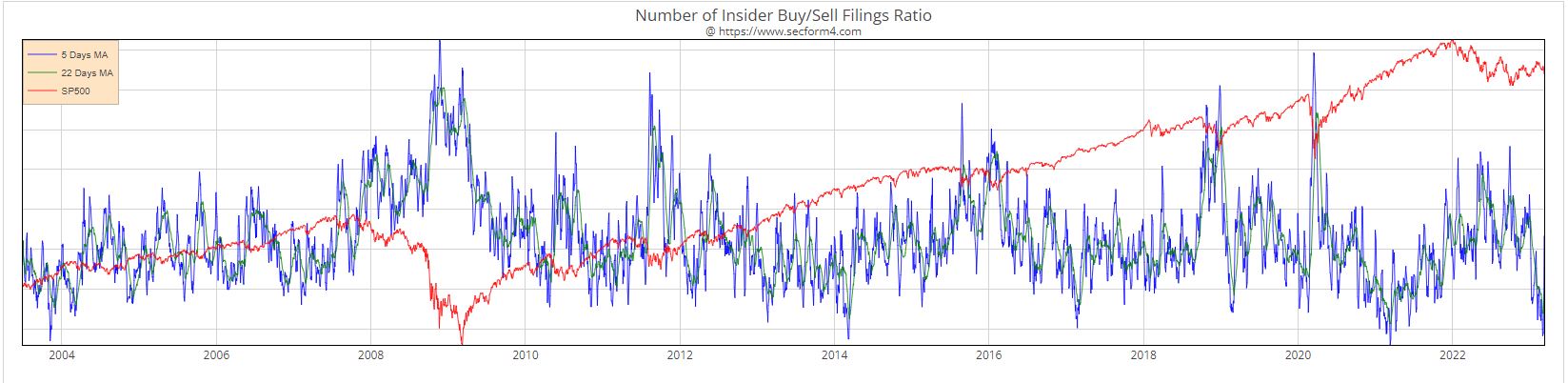

Insider Buying -Interest rates may have peaked but the damage to earnings is just beginning

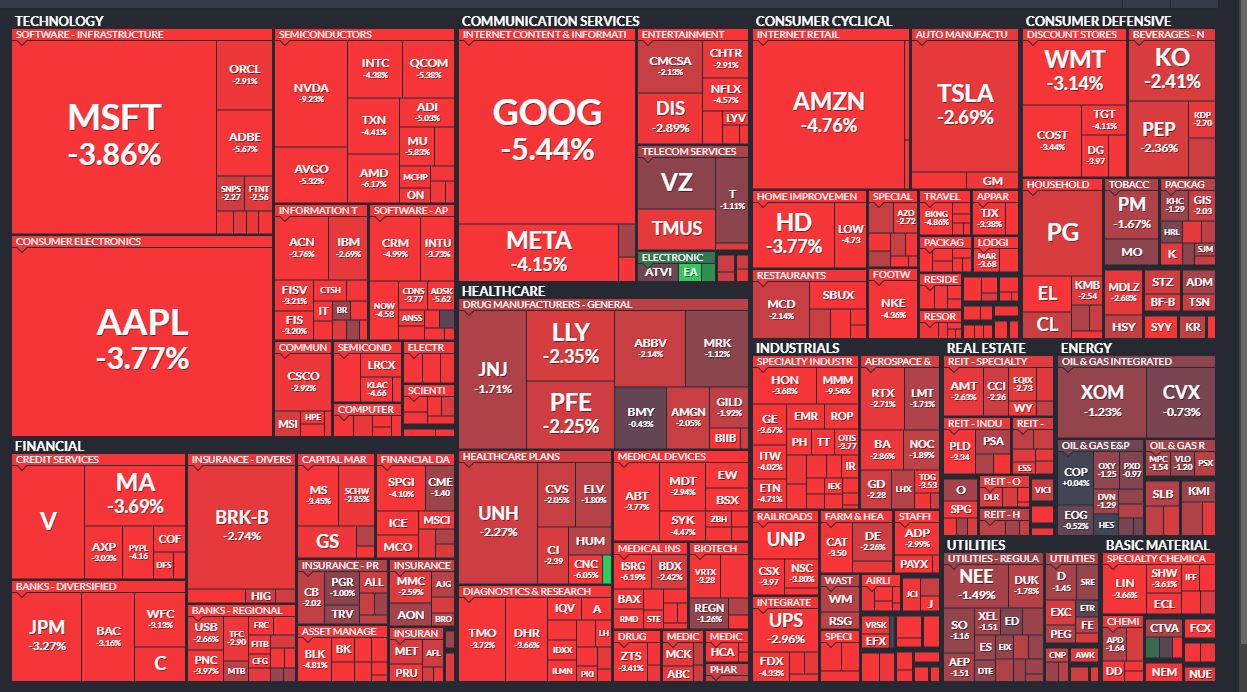

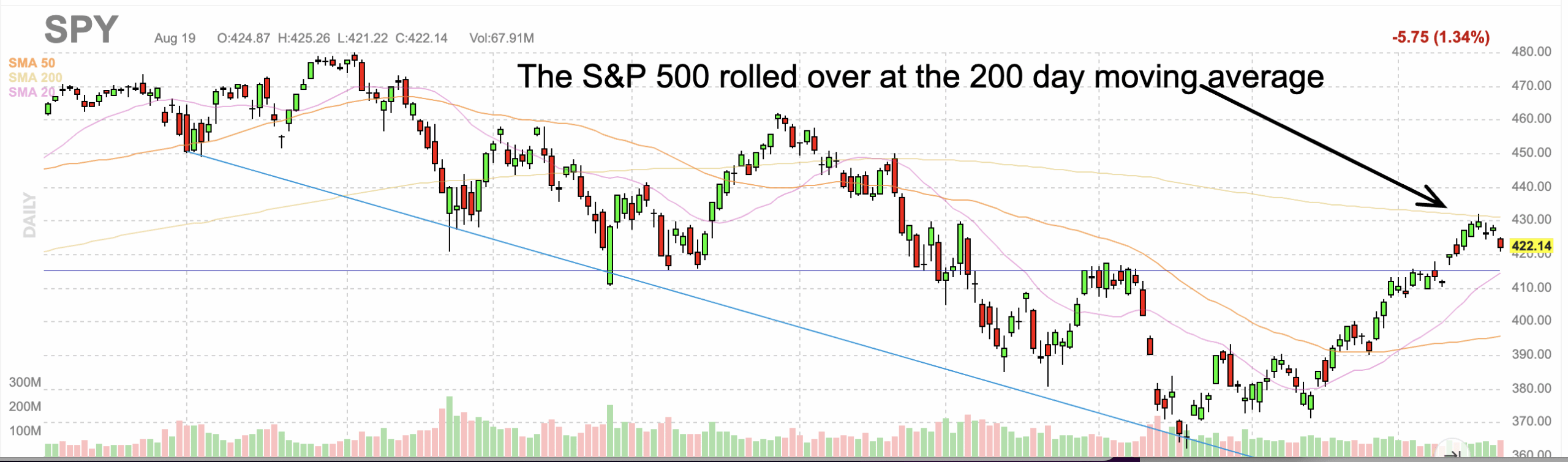

Market gains are muted, and traders are quick to snatch profits. Rallies are reversed almost daily as market direction is indecisive. By many measures, bargains in the stock market are hard to come by. The earnings yield of the S&P 500 is 3.98%, and the P.E. is historically on the low side. Earnings surprises are met with a sell-the-news trading mentality. The economy is showing signs of stalling, yet the Fed has made it clear, that if rate hikes are near the end of the cycle, high-interest rates will be here for quite a while. 10% car loans and 7.3% … Read more