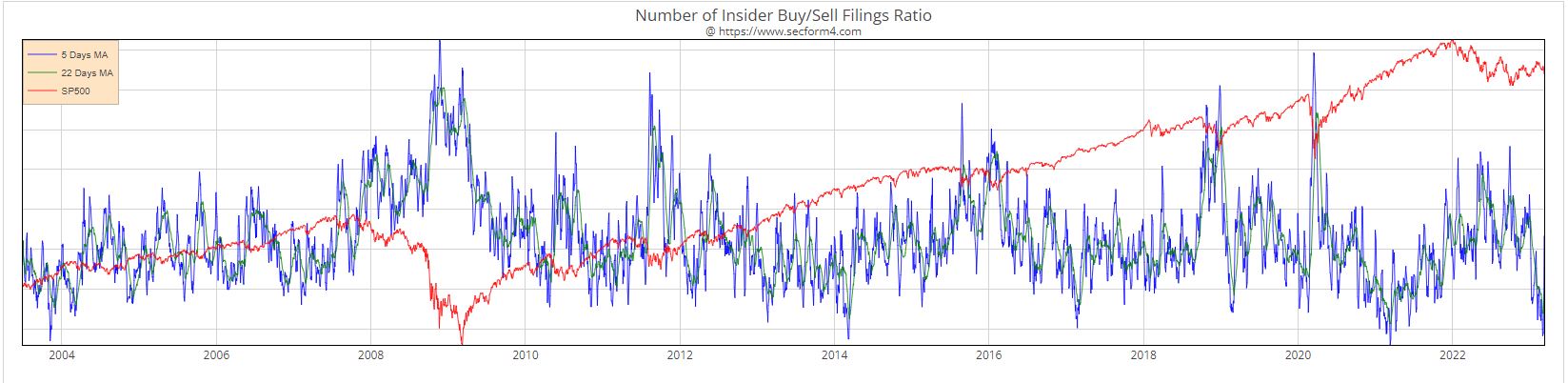

The Bull Charges as Bears Run in Disbelief Insider Buying Week 3-31-23

It may be the calm before the storm but the bulls are running. The Fed’s rapid interest rate hikes came to a screeching halt last week. The Fed’s favorite inflation indicator, the Personal Consumption Expenditures Price (PCE) Index came in below expectations Friday. Hiking interest rates has been one of the key policy tools used by the Fed to cool the economy and ease inflationary pressures. Many investors have been concerned about whether the pace of rate hikes and keeping rates higher for longer could drag the U.S. economy into a recession. That all came to a sudden and unexpected … Read more