‘t Fight the Trend

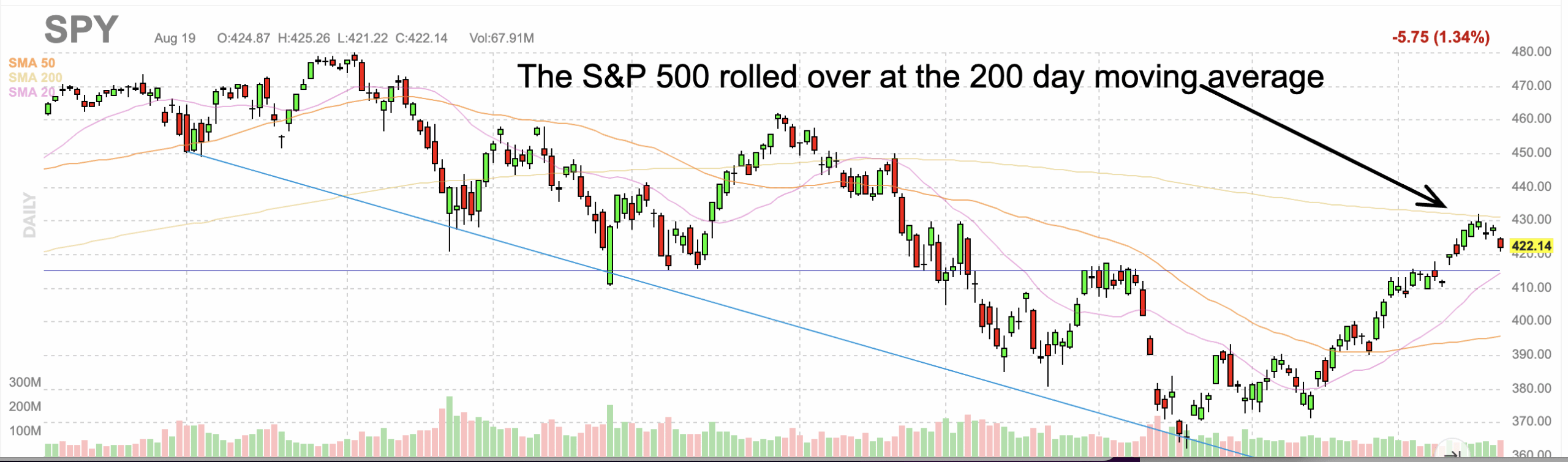

The market pin action has been exceptionally strong. Don’t fight the trend is a popular saying many people have uttered along with ‘ other profound market nuggets of wisdom. They work until they don’t. Late breaking headlines about non-essential U.S. Government employees being told to leave the MidEast caused oil to spike $3 and the market to sell off some late Friday. Yet full blown war between Israel and Iran is greeted enthusiastically. Perhaps too much so. Israel hasn’t been able to get out of Gaza, so Iran is a problem multitude of order more challenging. For the moment the … Read more