Insider Buying 02-14-25 Buyers Coming Back as Blackout Abates and Uncertainty Rocks Stocks

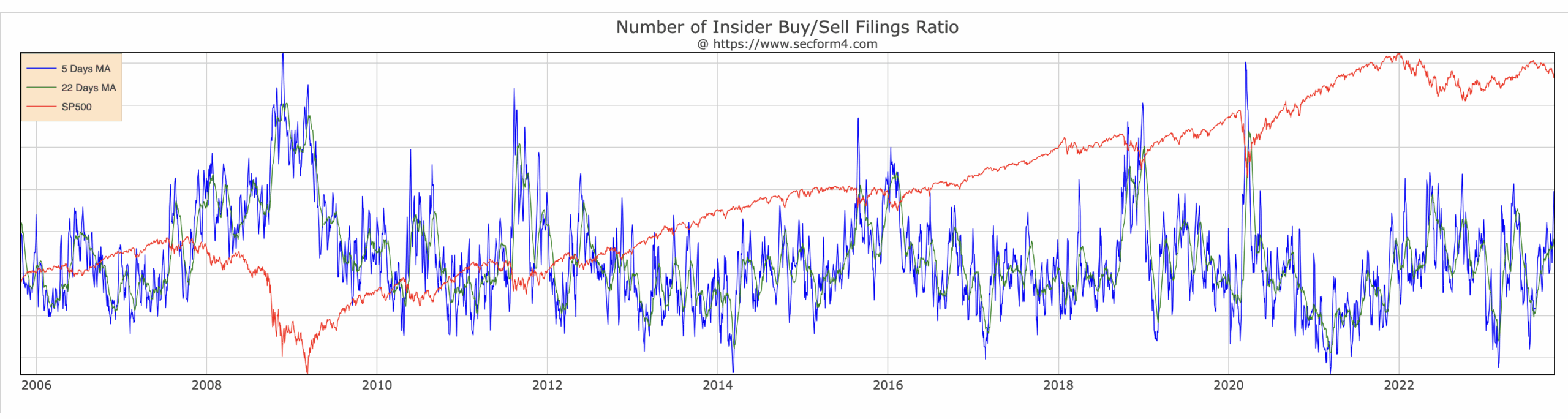

As Q4 earnings announcements start to wind down, we would expect to see a pickup in insider activity. We are seeing that, particularly in sectors that have sold off in anticipation of possible Trump regulatory changes that would make business more challenging and potentially less profitable. Of course, no one really knows for certain about any of this as Trump has shown a great propensity to say one thing and actually do another. He may be bluffing, posturing or may change his mind. It’s very unpredictable but you have to assume when insiders buy into this, they are considering this, … Read more