Insider Buying Week 8-26-22 Jerome Powell Debuts at Jackson Hole as “Chucky “

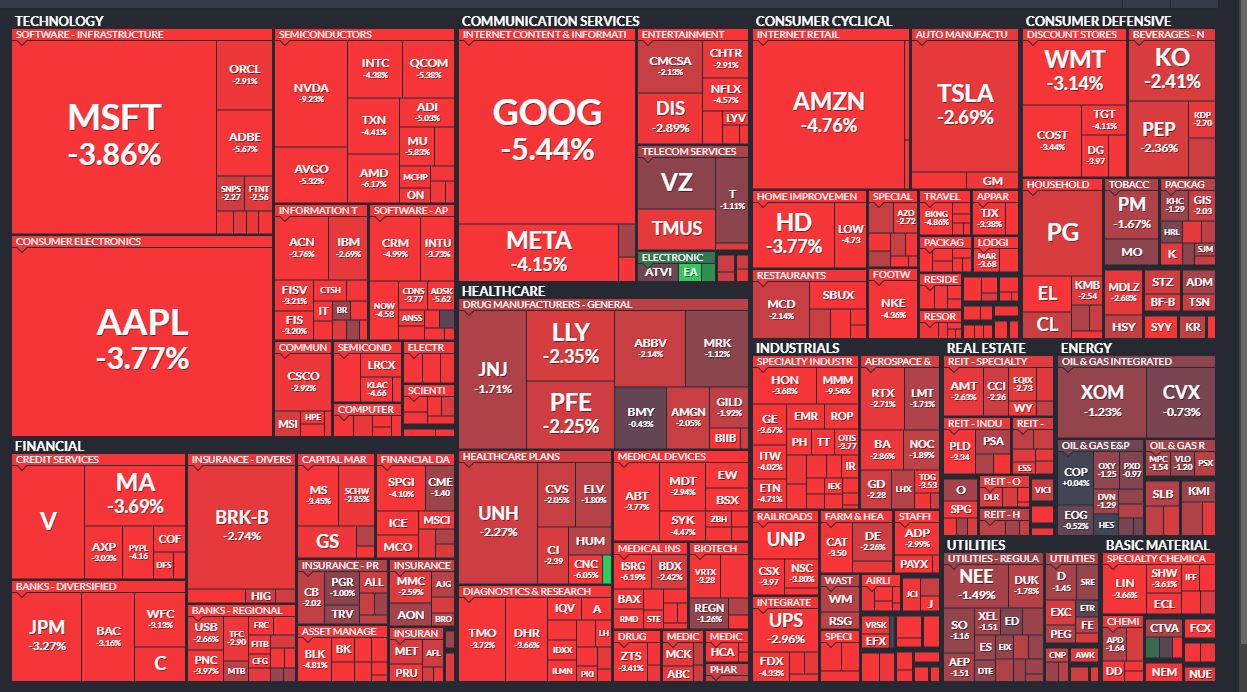

Curious how well insiders are doing with their buys? Scroll through the significant buys of the last year. Friday was a blood bath. The Dow dropped 1000 points. Jerome Powell played Chucky, the criminally insane doll that came to life. With stunning, chameleon-like performance, he morphed into Paul Volcker, warning the investment community about the pernicious destructive nature of inflation. Volcker is the Fed Chairman that was famous for crushing the inflation of the 1970s by running interest rates into the high teen percentage points. I personally think it was the most boneheaded policy I’ve lived through. the economic equivalent … Read more