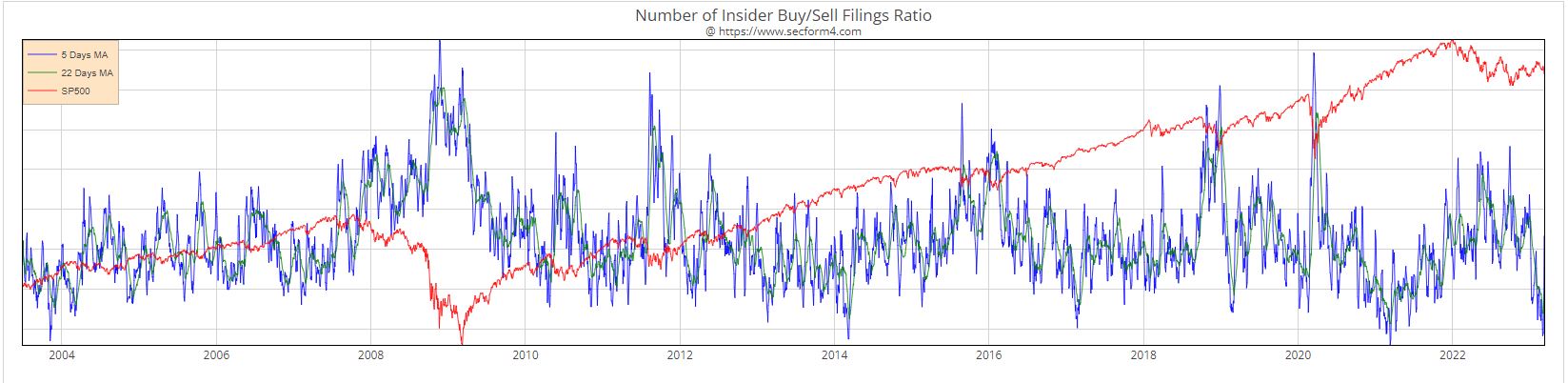

Insider Buying Week 5-12-23 Prelude to Something but What?

Insiders are coming out in force to buy regional and community banks. Normally significant insider buys are met with a predictable market response, a positive bounce between 3%-5%. This is not happening. There is no urgency, as the stocks, for the most part, are lower than when the “informed investor” purchased the shares. I like to believe that no one knows more about the business than the people running it, but banks may be a glaring exception to my dogma. First of all, banks’ balance sheets are complicated and notoriously obtuse. 2008 should serve as an indelible reminder of that. … Read more