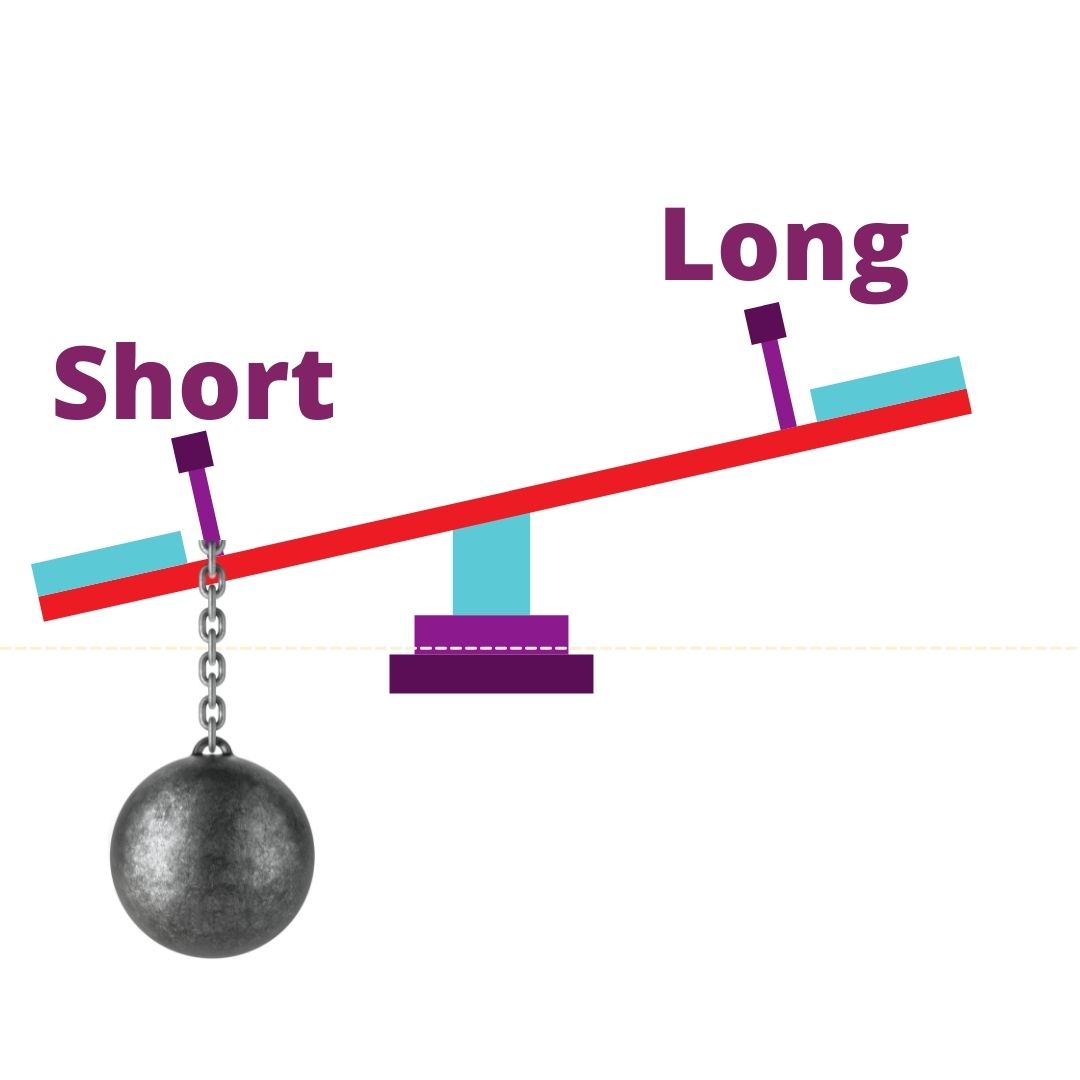

Insider Buying Week 9-7-22 The Seesaw was Heavy on the Short Side

Curious how well insiders are doing with their buys? Scroll through the blog posts and see for yourself Last week, the market reversed its sour mood with a thunderous rally propelling the S&P 500 by 3.52%. Our insider buys did even better, notching an average of 5.73% returns. Heavily shorted stock, no matter how poor their prospects doubled that. It was the classic case of everybody on the same side of the seesaw. In keeping with the old adage, the market will figure out how to screw most people most of the time. Name: Robert J Mylod Jr Position: … Read more