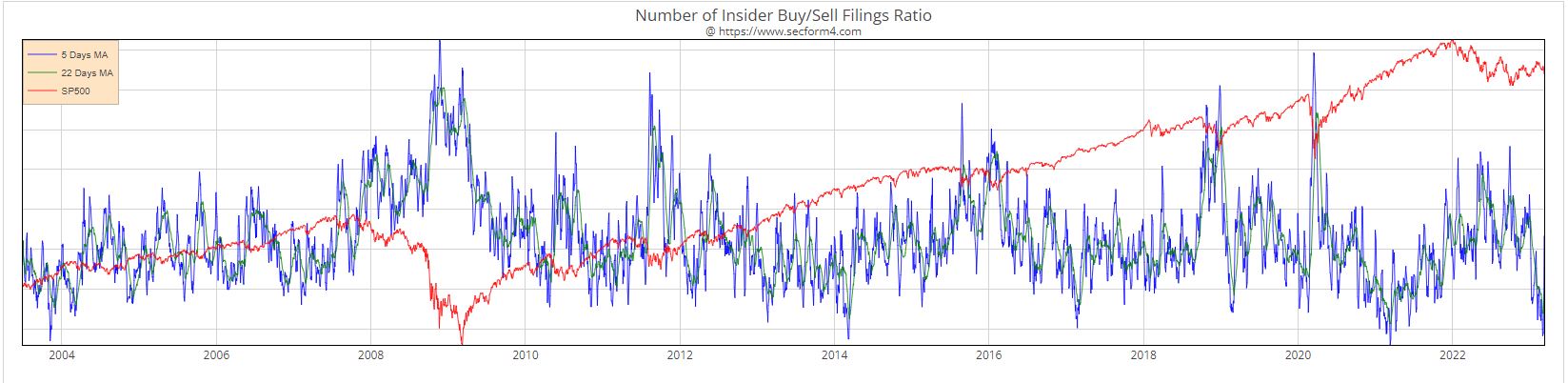

Insider Buying 03-07-25 Chaos-2.0 Treasure Hunt Continues

CHAOS 2.0 unfolds as expected with a sharp drop in interest rates as market participants pivot from worrying about inflation to crumbling public sentiment and the likelihood of rising unemployment numbers. February employment numbers failed to assuage the sense that the U.S. economy is about to rollover as an inconsistent implementation of tariffs, pall-knell like approach to trimming Government fat, and a clear failure to lead the electorate has created a witch’s pot of discontent. Stocks are predictably down, the only question being is this a trend or a bottom. The jury is still out on that. As for me, … Read more