Insider Buying Week 3-11-22

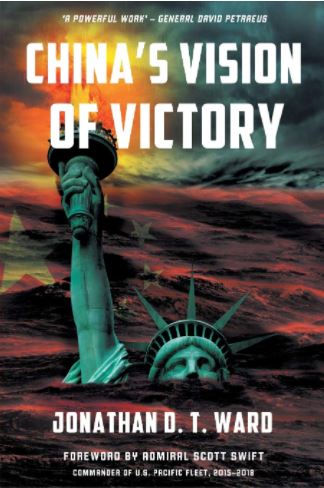

Curious how well insiders are doing with their buys? Scroll the significant buys of the last year. And what to do about the Russian Ukraine war. It will get worse and it will drag China into an ever-deepening conflict with the West and Democratic regimes. The declaration of mutual support that Russia and China published in a 5000-word memorandum entitled Joint Statement of the Russian Federation and the People’s Republic of China on the International Relations Entering a New Era and the Global Sustainable Development was reminiscent of the Axis power alignment with Germany and Japan at the onset of WWII. If we’re headed to WWW3 is that a reason … Read more