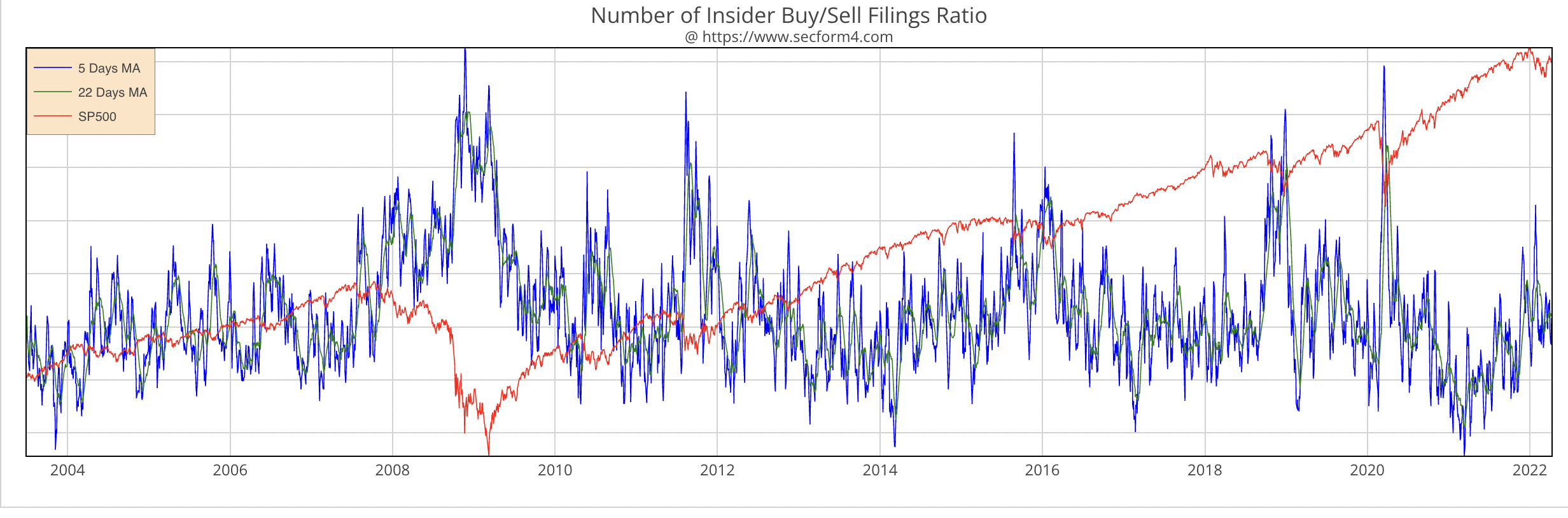

Insider Buying Week 05-16-25 The Best Insider Buy/Sell Ratio in a Year

The busiest week we’ve seen in some time. In fact, it’s so busy that I would venture to say that a short-term bottom is in and there is a more room to the upside. It’s basically all in now and I don’t often make a call like that. Of course, we won’t know that for months, but this is the most bullish Insider Buy/Sell Ratio in a year. At least it gives us a lot to ponder. There are a lot of compelling insider buys this week. As usual insiders are value buyers, preferring to buy their stocks nearer … Read more