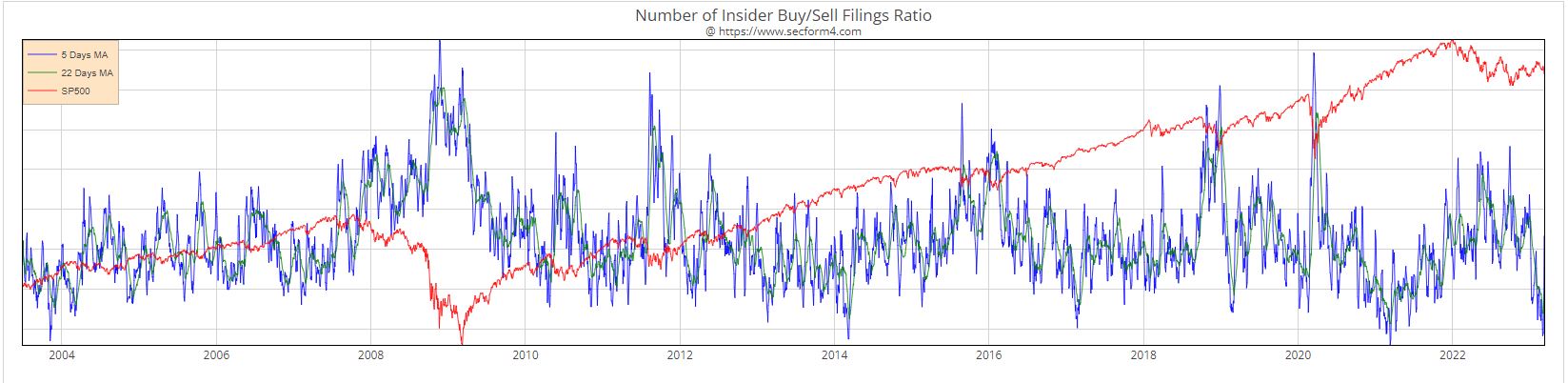

Nothing much to write about regarding notable insider buys; there wasn’t much of note. But that Doesn’t mean there isn’t great profit making opportunities.

C Level officers, directors and 10% or more shareholders are the insiders that are required to file Form 4 within 48 hours. The quarterly earnings blackout period has prevented some insiders from buying last week but it didn’t prevent insiders at EchoStar, SATS, from unloading over $25 million of their stock now that Elon Musk put a bid on the table for Dish’s wireless spectrum that caused SATS to go from$28 to Friday’s closing price of $74.89, just a mere 166% increase in value.

If you ignore insider buying, well you just missed the biggest stock market gift you’ll likely get in any nine month period. It was only back in December that Charlie Ergen, founder of Dish and wireless spectrum speculator, (now legendary) added $43.5 million shares of SATS on the open market at $28.04 . At the time it was reported he owned holdings of 16,042,800 shares. You might ask yourself as a DIY investor, how do I get in on this? You might ask your financial advisor or hedge fund manager where were you when Charlie loaded up.

Well, you guessed it- they were not paying attention to insider buying.

Listen to our The Insiders Fund Not So Daily Podcast and Follow us on X for real-time commentary and insider buying alerts

If you are a QUALIFIED INVESTOR and are interested in learning how you can be part of the Insiders Fund, schedule some time with me here.

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that. Nothing contained here constitutes a recommendation to buy or sell any security. Investing involves risk, including the possible loss of principal, and past performance is not indicative of future results.

“The insomniac hedge fund guy” is a moniker Harvey Sax, the portfolio manager for The Insiders Fund” has used from time to time on email, blog ,and social media posts. While Mr. Sax is the portfolio manager of The Insiders Fund, these posts are not communications from, nor endorsed by, Alpha Wealth Funds, LLC or any of its managed funds. References to Alpha Wealth Funds or its affiliates are for identification only and do not imply sponsorship or approval.”